FEATURES

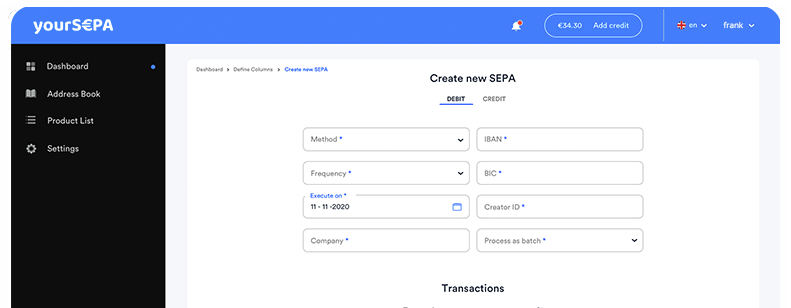

Create or modify a SEPA XML easily

Easily generate and adjust SEPA XML files with a streamlined, reliable tool designed to simplify your payment processes.

Seamless import from multiple file types

Import your data from Excel, CSV, ClieOp3, or existing SEPA-XML files and convert them into the SEPA format within seconds. YourSEPA integrates effortlessly with the tools you already use.

Enhanced security with SHA-256 and MD5 hashes

Keep your data safe with advanced encryption. YourSEPA leverages SHA-256 and MD5 algorithms to secure your information during file transfers.

Online

Create SEPA files anytime, anywhere

Easily collect invoices with automatic direct debits or generate payment files to manage multiple transactions in one go—all through a secure online platform.

Try it free—no strings attached

Experience the convenience of YourSEPA with a free trial. Test our software without any commitment and see how it simplifies your payment processes.

Accessible on any device, anytime

As a cloud-based tool, YourSEPA works seamlessly through your browser on Windows, Mac, Linux, and more. No installation needed—just log in and get started.

PREVIEW

Get to know YourSEPA

Curious how YourSEPA can streamline your SEPA XML file creation? Watch our product video to see just how easy it is.

PLANS

Our pricing plans

Choose the YourSEPA plan that fits your business needs and start simplifying your SEPA and payment file processes.

Explore

1

transaction per fileFree

(No Credit Card Needed)Flexible

3.000

transaction per fileOnly € 2,99

Per transaction (max 1 hour)€ 9,99

minimum top-up amount per yearSubscription

3.000

transaction per file€ 8,33

per month (payed annually)ANSWERS

Frequently asked questions

Have a question? Check out our list of frequently asked questions to quickly find answers to the most common questions about our product.

To generate a SEPA XML file, you need to have a direct debit contract with the bank and possess an ‘Incassant ID’. This ID is provided by the bank and can then be entered into YourSEPA.

Yes, you can. With YourSEPA, you can import XLS, CSV, or XML files and convert them to SEPA XML.

There are several options to use YourSEPA. We offer a free trial version so you can test our software. If you’re satisfied, you can use our flexible model where you can add funds to your account. The minimum amount to add to your account is €9,99. We charge €2.99 per SEPA XML batch.

We also offer a Subscription model where you can use our software unlimitedly for €100 per year.

No, you don’t need to install any special software to use YourSEPA. YourSEPA is a SAAS (Software as a Service) product, which means you can use it without installing any software. All you need is a computer with an internet connection and a web browser. It’s recommended to use YourSEPA on a desktop computer or laptop, as the software generates an XML file that needs to be saved and later imported to your bank.

A Mandate ID is a unique identification number assigned to a direct debit mandate. A direct debit mandate is the authorization that a customer gives to a company to withdraw a certain amount from their account. The Mandate ID must be unique and is generated by the company that receives the direct debit mandate. The number must then be included in the SEPA XML file used for the direct debit instruction. The Mandate ID is then used by the bank to identify the direct debit mandate and process the correct payment. It is important to remember that the Mandate ID must remain the same during the period in which the direct debit takes place, to avoid confusion or errors in the processing of payments.

A mandate date is the date on which a customer has given permission for a direct debit mandate. The direct debit mandate is the authorization that a customer gives to a company to deduct a certain amount from his or her account. In short, it is the date on which the direct debit has started.

Yes, on the instruction video page of YourSEPA, you will find instructional videos that demonstrate how the platform works.

A regular direct debit is intended for consumers and individuals, while a business direct debit is intended for companies and organizations. For a regular direct debit, a prior announcement must be sent before the direct debit, while this is not necessary for a business direct debit. Furthermore, different rules and conditions apply to a business direct debit than to a regular direct debit. For example, companies must enter into a specific direct debit agreement with their bank and cannot reverse the direct debit amount without the debtor’s permission.

Unfortunately, we cannot assist you with uploading the SEPA XML file to your bank, as we only focus on generating the file. But don’t worry, your bank is there to help you and they often have their own specific instructions for uploading files. Don’t hesitate to contact your bank if you have any questions about this!

YourSEPA takes the security of data very seriously and we continuously work on improving our security measures. To ensure the safety of our customers, we use various security measures.

First of all, our servers are ISO-certified, which means that they meet international standards for information security. This means that we are regularly audited on our security processes and that we make sure that we are always up-to-date with the latest security standards.

In addition, we use a secure SSL connection. This is an encrypted connection between the user’s browser and our servers, which prevents third parties from accessing data that is transmitted between the browser and our servers. This ensures that our customers’ data cannot be intercepted and viewed by unauthorized persons.

Finally, we use data encryption. This means that all data stored on our servers, such as bank details and other personal information, is encrypted. This makes it virtually impossible for hackers to gain access to this data.

Create or edit SEPA XML files with ease

YourSEPA simplifies payment management, giving you more time to focus on your business. Try it free with no commitment—pay only for what you need.

8/10 Customer rating